Ethereum Gains Momentum as Bitcoin Falters

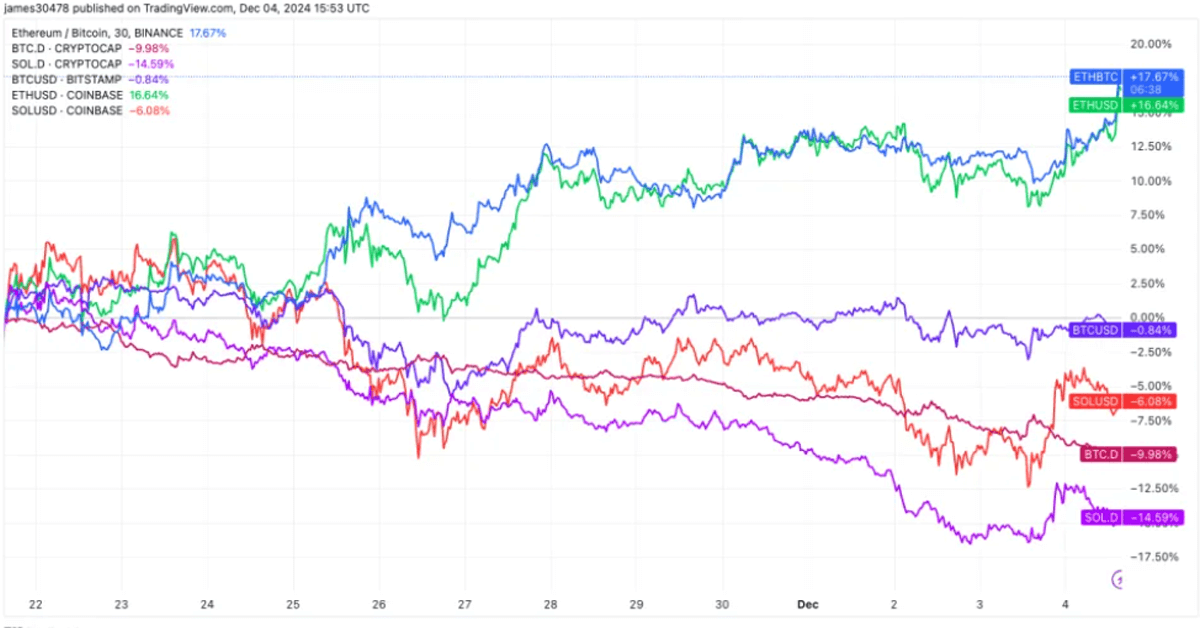

Ethereum (ETH), the second-largest cryptocurrency by market cap, surged by an impressive 8% in just 24 hours, breaking past the $3,880 mark. This dramatic price action signals a potential shift in the crypto market’s dynamics, as Bitcoin’s (BTC) dominance continues to decline. Experts attribute Ethereum’s rise to several key factors, including a short squeeze, capital influx, and investor confidence reminiscent of the 2021 bull run.

Behind Ethereum’s Rally

The sharp increase in Ethereum’s value follows a significant closure of short positions, with approximately $800 million in shorts being liquidated. Tom Dunleavy, a partner at Master Global, highlighted how these liquidations contributed to the price momentum. Additionally, James Van Straten, a senior analyst at CoinDesk, pointed out that Ethereum’s gains align with broader market trends as capital flows into altcoins intensify.

Bitcoin’s dominance in the crypto market peaked at 61.85% on November 21 but has since fallen to 54.84%. This decline has opened the door for Ethereum and other cryptocurrencies to shine. Ethereum’s rise also coincides with a similar trend across the CoinDesk 20 index, which tracks the performance of the top 20 cryptocurrencies excluding stablecoins and memecoins. Notable performers include Ethereum Classic (ETC), Filecoin (FIL), Polkadot (DOT), and Uniswap (UNI), which saw gains of 22%, 18%, 17%, and 16%, respectively.

Bitcoin’s Flat Performance and the Fed’s Influence

Bitcoin’s lackluster performance during this period has surprised many, given its typical role as the market leader. Despite Federal Reserve Chair Jerome Powell’s remarks at The New York Times’ DealBook Summit, Bitcoin’s reaction remained muted. Powell described Bitcoin as a speculative asset akin to gold, emphasizing its volatility and limited use as a payment method or store of value. His comments reaffirmed that Bitcoin does not currently pose a threat to the U.S. dollar but functions more as a digital competitor to gold.

Powell also addressed the importance of consumer protection and the stability of the banking system as priorities in integrating cryptocurrency into the broader financial framework. These statements, coupled with market conditions, have kept Bitcoin’s price relatively stable, allowing Ethereum and other altcoins to steal the spotlight.

Altcoins and Broader Market Trends

Ethereum’s recent success is not an isolated event but part of a broader trend. Many cryptocurrencies in the altcoin space have experienced notable gains as investors diversify beyond Bitcoin. The market sentiment reflects a renewed confidence in alternative digital assets, driven by innovative use cases and improved adoption rates.

Other factors influencing this trend include global economic conditions, political instability, and a growing interest in decentralized finance (DeFi). As traditional markets grapple with uncertainty, cryptocurrencies like Ethereum offer a hedge against risks associated with fiat currencies and traditional asset classes.

Ethereum’s Competitive Edge

Ethereum’s ability to capitalize on Bitcoin’s sluggish performance highlights its growing importance in the crypto ecosystem. Unlike Bitcoin, which primarily serves as a store of value, Ethereum powers a vast array of decentralized applications (dApps) and smart contracts. This utility has made it a favorite among developers and investors seeking long-term growth.

The Ethereum network’s transition to a proof-of-stake (PoS) consensus mechanism through the Ethereum 2.0 upgrade has further enhanced its appeal. PoS not only improves scalability and energy efficiency but also attracts environmentally conscious investors. These advancements position Ethereum as a strong contender in the crypto market, capable of challenging Bitcoin’s dominance.

Global and Political Factors Shaping the Crypto Landscape

The broader market dynamics influencing cryptocurrencies like Ethereum extend beyond technical developments. Geopolitical instability, including the no-confidence vote in France’s government and impeachment proceedings in South Korea, has prompted investors to seek alternatives to traditional investments. Cryptocurrencies, with their decentralized nature and global accessibility, provide a compelling option during times of uncertainty.

Furthermore, macroeconomic trends such as inflation concerns and central bank policies continue to shape investor behavior. With the Federal Reserve signaling a cautious approach to achieving fiscal neutrality, the demand for decentralized assets like Ethereum is likely to grow.

The Road Ahead for Ethereum

As Ethereum’s price climbs and its dominance increases, the cryptocurrency is poised for a promising future. Analysts believe that the current rally could mark the beginning of a broader market shift, where altcoins play a more significant role in shaping the crypto landscape. However, challenges remain, including regulatory scrutiny and competition from emerging blockchain platforms.

Investors should keep an eye on key developments, such as Ethereum’s network upgrades, market trends, and global economic factors, to gauge the cryptocurrency’s long-term potential.

Conclusion

Ethereum’s recent 8% surge underscores its resilience and growing prominence in the crypto market. As Bitcoin’s dominance wanes, Ethereum and other altcoins are stepping up, offering investors new opportunities and diversifying the digital asset landscape. With its innovative technology, robust ecosystem, and increasing adoption, Ethereum is well-positioned to continue its upward trajectory and solidify its status as a market leader.